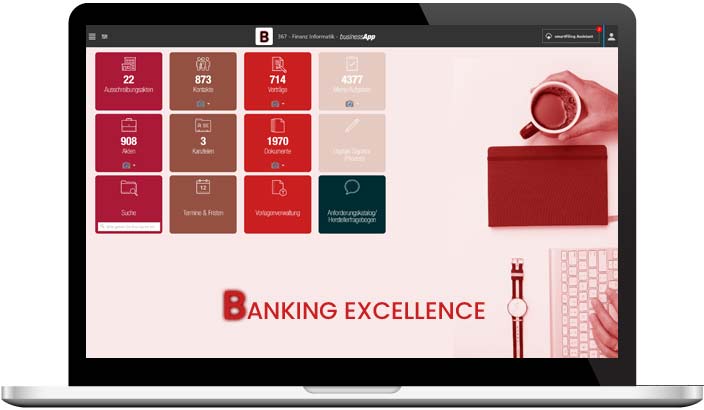

Software for banks

Flexibly expandable banking software to meet all regulatory requirements with a high level of user-friendliness

The banking industry has to adapt continuously: New regulatory requirements, high IT security standards, digital data transfer, international payment processes. In addition, complex software technologies are used to automate daily internal processes. Digitalization in the banking industry is already at a very high level today.

A digital platform is the basis for any sustainable and legally secure implementation in accordance with the requirements of DORA (Digital Operational Resilience Act) of the EU, the European Central Bank (ECB), the Single Resolution Board (SRB), or the FMA and OeNB. The fulfillment of the following contract types (here are just a few examples) can be ensured with a digital platform:

- Settlement-critical contracts

- Outsourcing contracts

- Operational risk management

DORA: Resilience and security for your IT systems - no chance for cyber threats

The EU is taking decisive action to combat the growing cyber threats posed by advancing digitalization. With the Digital Operational Resilience Act (DORA), it is laying down clear guidelines for the financial sector to strengthen cybersecurity, ICT risk management and digital operational resilience.

What is DORA?

DORA is an EU-wide regulation that creates a uniform framework for financial institutions to ensure the operational resilience of their digital systems. The aim is to establish uniform standards to protect the IT infrastructure in the financial sector and coordinate existing European and national measures. From 2025, all companies in the financial sector must be able to demonstrate that their organization can withstand various ICT crises and that the operational stability of their digital systems is guaranteed at all times.

What are the requirements of DORA?

The directive places high demands on companies to ensure digital operational stability not only internally, but also with associated service providers. Above all, meeting these legal requirements requires an integrated and comprehensive database as well as extensive testing capacities.ICT Risk Management

Reporting ICT-related incidents

Tests of digital operational resilience

ITC risk management with third-party providers

Monitoring framework for critical ICT third-party service providers

Rules for the exchange of information

TQG businessApp cloud platform: master the requirements of DORA

The TQG businessApp cloud platform offers a range of security features, including encryption, access control and monitoring tools to ensure the security of sensitive data.

The platform enables continuous monitoring of the IT infrastructure and applications in order to identify and eliminate potential vulnerabilities at an early stage.

Fully ensure compliance with DORA regulatory requirements, including logging, reporting and audit functions.

- Additional regulatory requirements (by banking supervision, etc.)

- Additionally required functionalities

- Personalization of the user interface to ensure a high level of user-friendliness

To meet these requirements, TQG business App platform® covers the full range of contract management, from capture to reporting and analysis:

Creation of contracts

- Easy data entry of contract meta-data

- Automation with template and clause management module

- Collaboration function (CBO, procurement, legal, suppliers)

- Approval workflow & compliance checklist

Central data management

- Role-based access control

- Central database / original documents in central archive

- Data on-premise: 100% data security

- Version management, document reconciliation & full traceability

Lifecycle & monitoring

- Alerting functions and resubmission with Outlook integration

- Visualization of contract dependencies

- Intelligent search module "Query Builder

Reporting and analysis

- Implementation of standard reports & graphical visualization

- Complete database metadata model

- Support of various functions

100% compliance and audit security

The TQG businessApp cloud platform is perfectly adaptable and expandable to your individual requirements in the banking sector. The adaptability must always be given due to, for example

- Additional regulatory requirements (by the banking supervisory authority, etc.)

- Additional functionalities that may be required

- Personalization of the user interface to ensure a high level of user-friendliness

To meet these requirements, the TQG businessApp cloud platform covers the full range of contract management, from recording to reporting and analysis:

- Implementation of standard reports & graphical visualization

- Complete metadata model of the database

- Support of various functions

- Logging of critical incidents, changes and adjustments

- Reporting

- Audit functions

- Alerting functions and resubmission with Outlook integration

- Visualization of contract dependencies

- Intelligent search module "Query Builder"

- Simple data entry of contract metadata

- Automation with template and clause management module

- Collaboration function (CBO, procurement, legal, suppliers)

- Approval workflow & compliance checklist

- Role-based access control

- Central database / original documents in central archive

- Data on-premise: 100% data security

- Version management, document synchronization & full traceability

TQG customers at home and abroad

Complete solution - consulting and software development

The TQG business App cloud platform is already present at well-known companies in the banking sector, for example at one of the top four Austrian banks!

We offer you a complete software solution, from consulting, conception and development. Feel free to contact us!